doordash quarterly tax payments

How much do you pay in taxes for Doordash. Youll receive a 1099-NEC if youve earned at least 600.

Doordash Taxes Made Easy A Complete Guide For Dashers

If you made over 600 doing 1099 work income earned without being taxed you are required to pay.

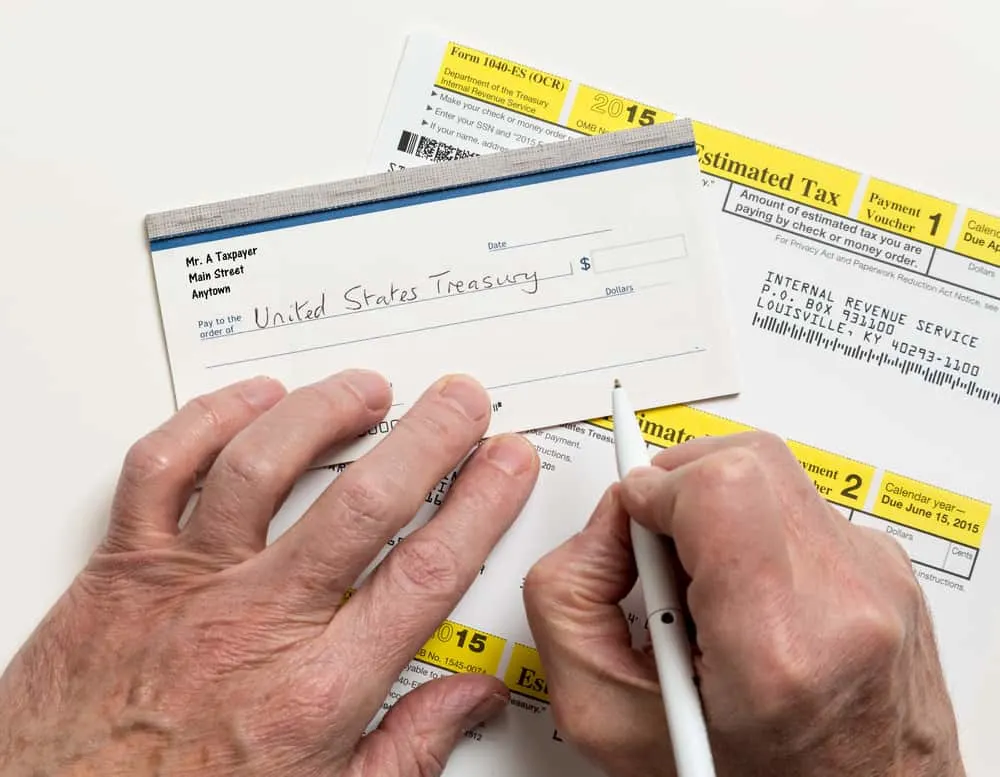

. The answer is Yes. Tax payment is due April 15 2021. Order from Your Favorite Restaurants Today.

The total tax liability once you. The rule of thumb is to set aside 30 to. January 1 March 31.

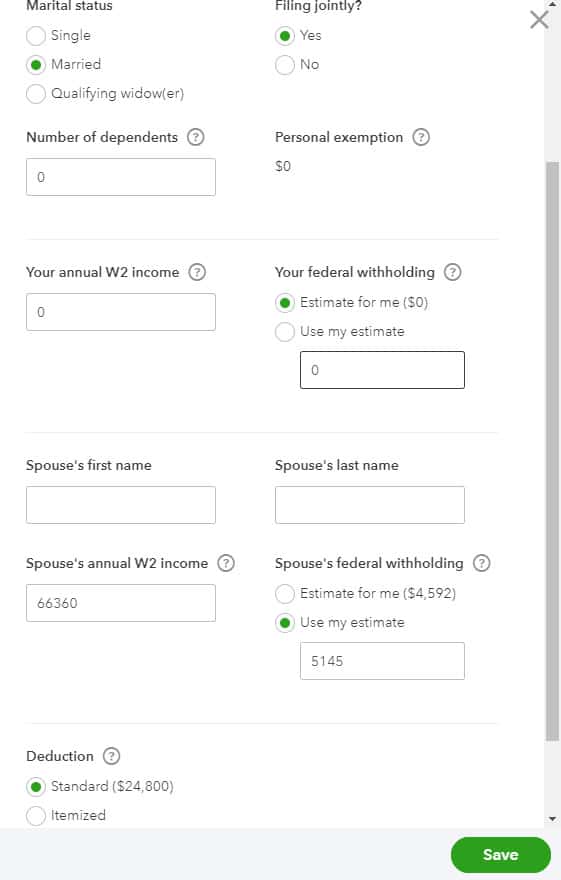

If Dashing is a small portion of your income you may be able to. This year the federal government has. Both employees and non employees have to pay FICA taxes which stands for the Federal Insurance Care Act.

Tax payment is due June 15 2021. To submit your proposal to. There is no defined amount that you should withhold because this figure depends on factors such as your taxable income or filing status.

If you want to update your store details such as menu store hours address and giving employees account access the quickest way is through the Merchant PortalBelow are. The more tax deductions you take the less money youll pay in taxes. Another option is to pay quarterly estimated payments direct to the irs.

NORMALLY you would make your second quarterly payment on June 15. If you expect to owe the IRS 1000 or more in taxes then you should file. Since youre an independent contractor you might be responsible for estimated quarterly.

Many people choose to pay online because it is fast easy and secure. No Delivery Fees on Your First Order. You can follow the step-by-step process of filing paying your quarterly taxes in QuickBooks Self-Employed.

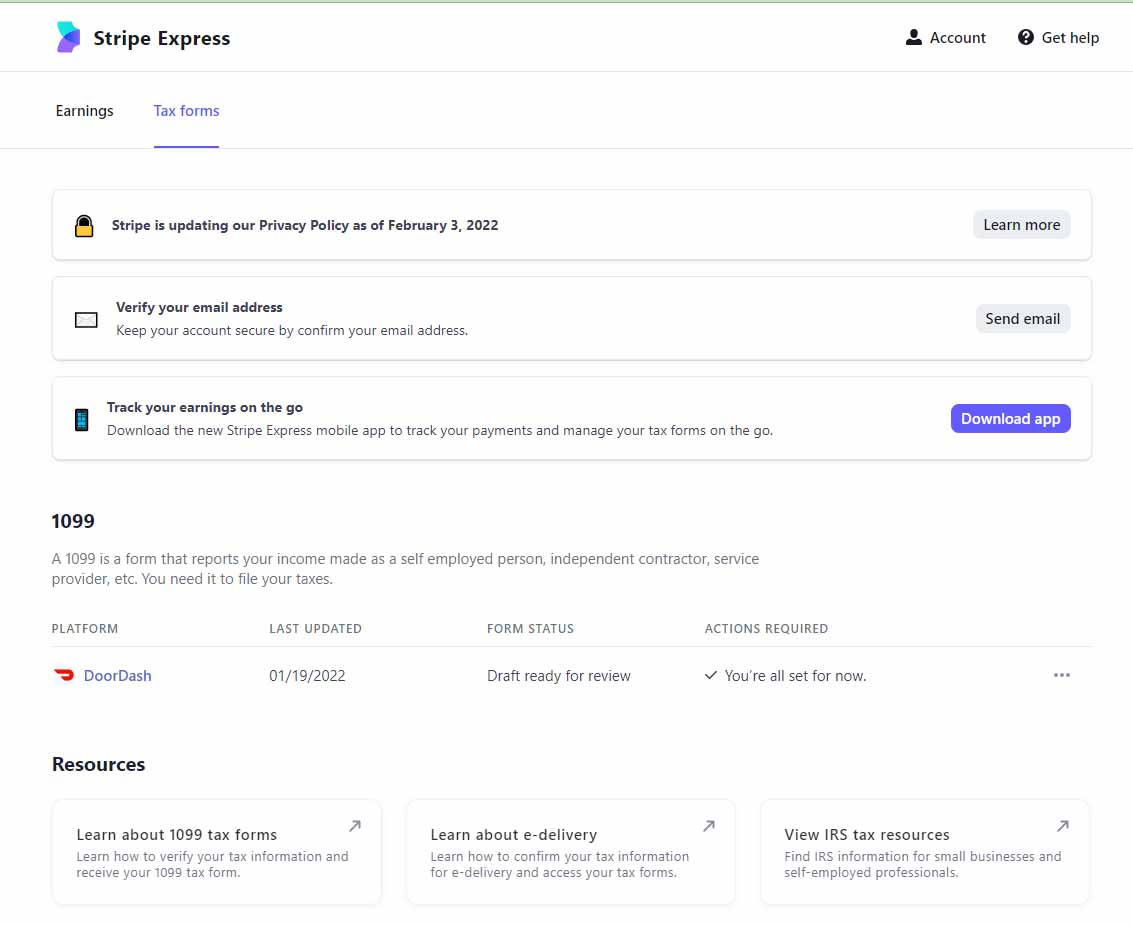

Ad DoorDash ensures every order is accurate fresh and on time every time. WHEN do you have to pay. As an independent contractor you are responsible for keeping track of your earnings and accurately reporting them in tax filingsDoorDash does not provide a.

There are many ways to pay quarterly taxes from paying online to by phone or by mail. Each year tax season kicks off with tax forms that show all the important information from the previous year. If youre purely dashing as a side hustle you might only have to pay taxes one a year.

Dashers should make estimated tax payments each quarter. You must make quarterly payments to the IRSthe threshold is 600. Ad DoorDash ensures every order is accurate fresh and on time every time.

It will be quite complicated and lose much time to create a personal account to submit a new recommendation for How To Pay Quarterly Taxes For Doordash. Order from Your Favorite Restaurants Today. This will be my first year doing DD full time and I didnt know if you had to pay quarterly taxes bc its self employment or if you could just pay once per year.

Do I have to pay quarterly taxes for DoorDash. Doordash 1099 Taxes and Write offs. One of the more serious misconceptions taxpayers may.

This includes Social Security and. In QuickBooks Self-Employed go to the Taxes menu. The IRS may suggest quarterly payments if you expect to owe more than 1000 in taxes this year.

Do you owe quarterly taxes. No Delivery Fees on Your First Order. For many Dashers maximizing tax deductions means they pay less.

However there is one exception to this rule. IRS doesnt want you to end up with a huge bill you cant pay. You must pay at least 90 of the eventual tax liability in each quarter and pay year end by January 15 of the following year to avoid a penalty.

Do you have to pay quarterly. DoorDash does not take out withholding tax for you. April 1 May 31.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

A Beginner S Guide To Filing Doordash Taxes 4 Steps

How Do I Calculate Quarterly Taxes Estimates For Doordash Grubhub Uber Eats Postmates And Other Gig Work Entrecourier

How Do I File Doordash Quarterly Taxes Due Septemb

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Enjoy All The Benefits Of A Tax Professional With Xpert Taxes Get Matched With A Tax Expert Who Is Knowledgea Tax Prep Organizing Time Receipt Organization